Page 6 of Article

Editorials on the economy, technology, and lifestyle by Dr Jiulin Teng

Some of Ferrari’s most collectible and unforgettable road cars are V12-powered grand tourers. Today, we look at the evolution of modern Ferrari two-seat GTs after the return of the front-engine V12 (berlinetta) layout over six generations.

Today, I compare the Mercedes S-Class and the BMW 7-Series over the last 6 or 7 generations from the matchup between W126 and E23, E32 to today's battle between W223 and G70.

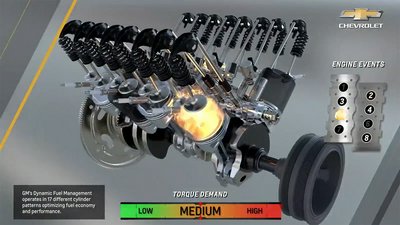

Today, I briefly cover how GM’s Dynamic Fuel Management (DFM) system works. It should then be obvious why it is superior to conventional cylinder deactivation technologies.

Emmanuel Macron took a gamble after the European elections last month with the snap election. After the first round, it appears to me that this high-stake gamble is likely to pay off with a strengthening of his grip on power.

Consumers commonly confuse the VAG EA824 and EA825 engines with each other. However, the Audi-designed EA824 and the Porsche-Audi EA825 are fundamentally different. Today, I compare the two across eight aspects.

Today, I briefly go over the mechanical and design evolutions of the Cadillac Escalade over its first five generations.

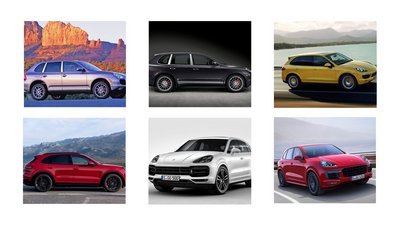

Today, I briefly go over the mechanical and design evolutions of the Porsche Cayenne over its first three generations. Emphases will be given to drivetrain and engine choice.

Russia's peace proposal marks a departure from the original goals of the SMO. It expresses a commitment to reach a definitive resolution of its existential conflict against the West by making sure that Russia's western borders will never be safe.

Today, we briefly examine the three main types of liner-less cylinder treatment methods that originated from Germany, Nikasil, Alusil, and Lokasil, and their variants.

There is a popular myth that planned economies do not have economic cycles. This goes against well-documented deep, lasting recessions that preceded the downfall of the Eastern Block. Today, I try to set the record straight as concisely as possible.

Today, I compare the Mercedes-AMG M156 6.2L V8, the Maserati F136Y 4.7L V8, and the BMW S65B40 4.0L V8 across seven aspects. These engines use equivalent technologies but differ appreciably in their design goals.

Self-driving cars have three major safety concerns: algorithm and computing power, electronics equipment, and network security. Today, I briefly explain each of them.